6 Minute Read

Winnipeg Chamber’s Policy & Research Analyst, Jamil Ahmed, highlights the latest Inflation updates in Manitoba.

Winnipeg Chamber’s Policy & Research Analyst, Jamil Ahmed, highlights the latest Inflation updates in Manitoba.

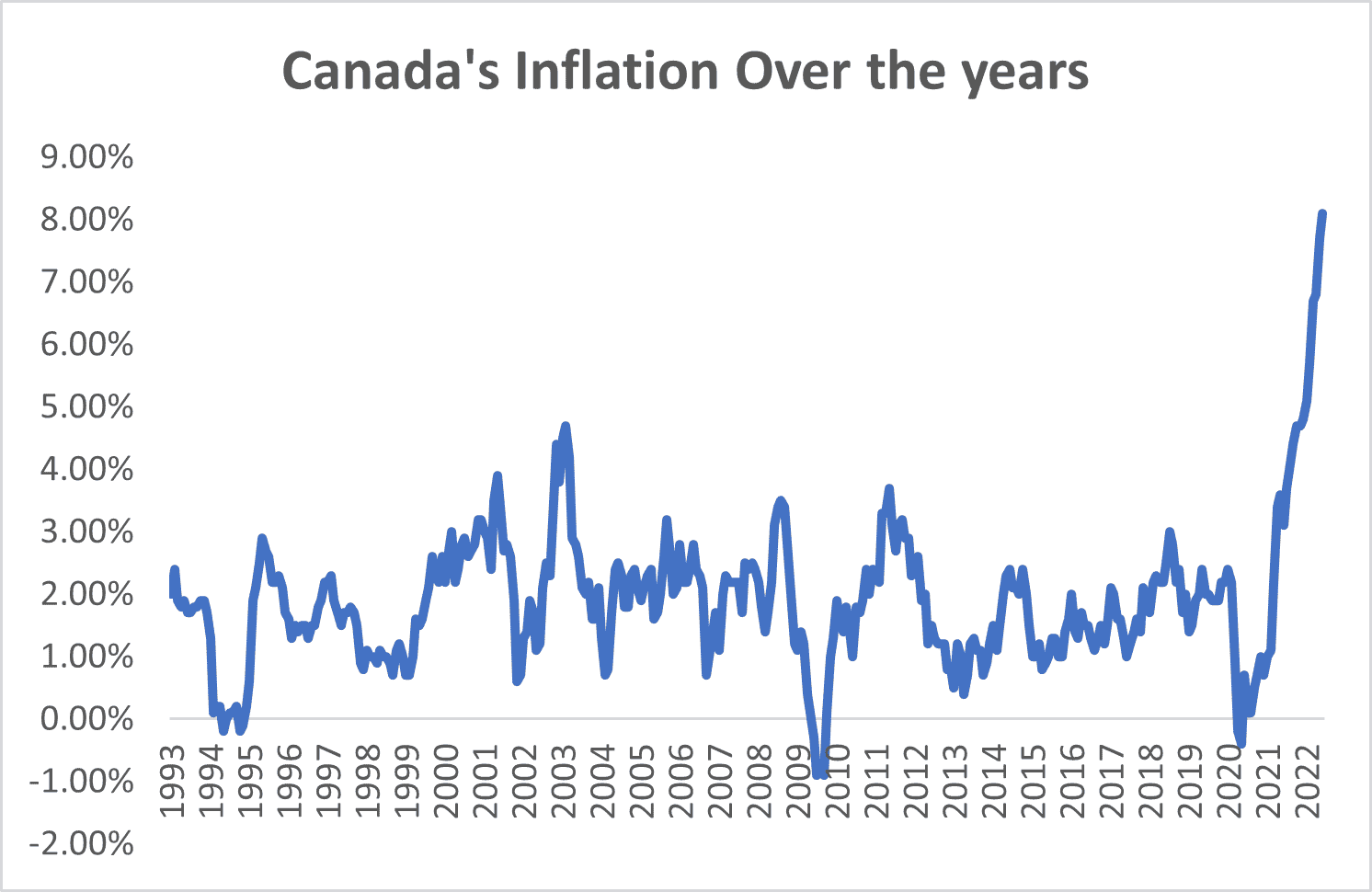

The consumer price index figures from Statistics Canada show that inflation reached a 39-year high of 8.1% last month, which is the highest yearly increase in the cost of living in decades.

On July 13, 2022, the Bank of Canada increased its target for the overnight rate to 2½%, with the Bank Rate at 2¾% and the deposit rate at 2½%.

Here are some key takeaways from analyzing Manitoba’s consumer price index for June 2022:

- Year-over-year, consumer prices nationwide increased quickly from 7.7% in May to 8.1% in June; since January 1983, this was the nation’s highest inflation rate (Figure 1).

Figure 1 : Source: Statistics Canada

- Manitoba’s All-Items Consumer Price Index (CPI) increased 9.4% year-over-year in June 2022, up from the 8.7% year-over-year increase in May. This is the most significant year-over-year increase since December 1982 (9.5%).

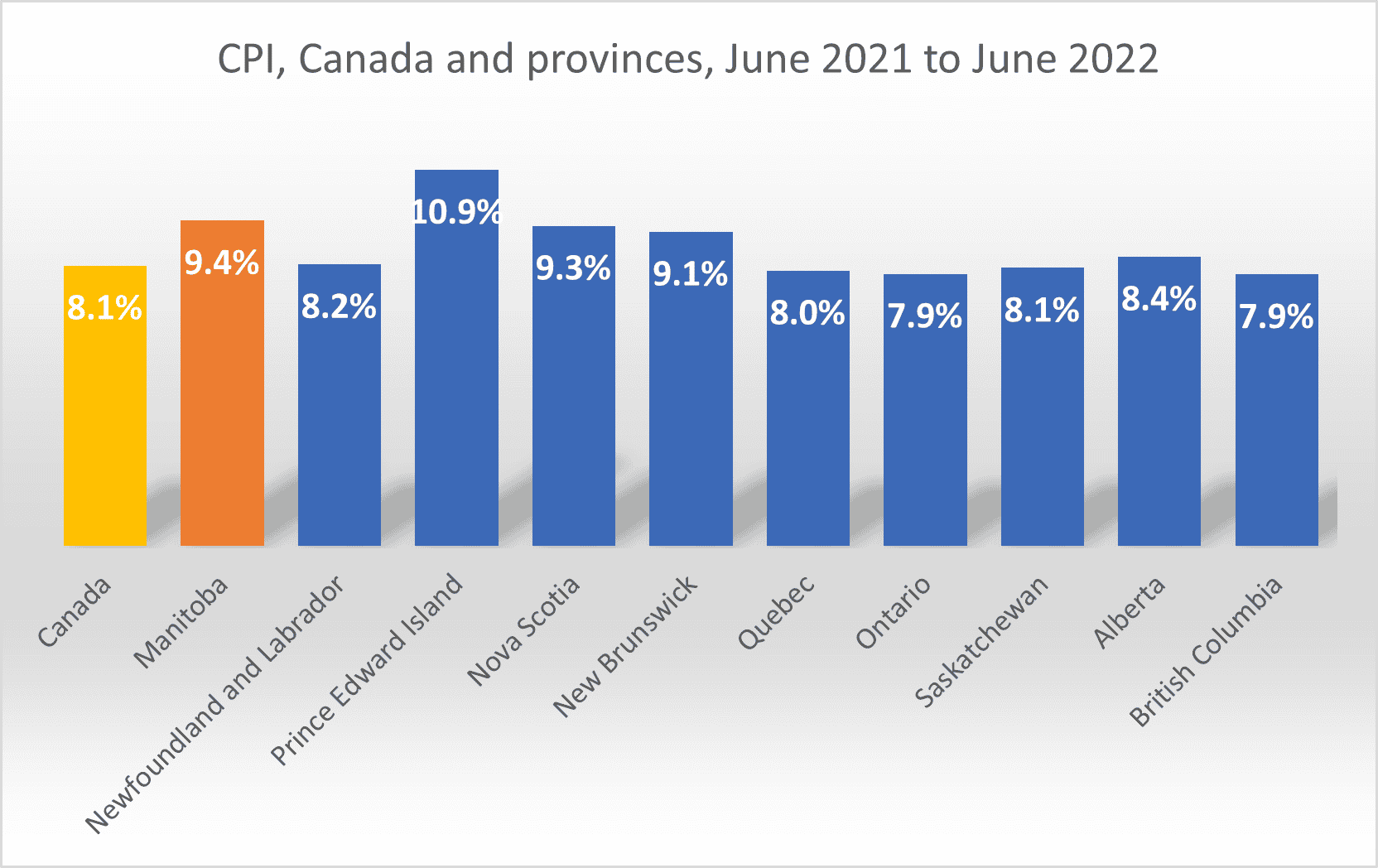

- Manitoba had the second-highest overall price rise in June. Among the ten provinces of Canada, at 9.4%. Prince Edward Island continued to have the highest year-over-year price growth, at 10.9%, while British Columbia and Ontario both had the lowest increases, at 7.9% (Figure 2).

Figure 2 : Source: Statistics Canada, Table 18-10-0004-01

- Inflationary pressures on prices as a whole continue to be heavily influenced by changes in the cost of energy. Manitoba’s consumer price inflation (year-over-year growth in CPI) for energy was 40.7% in June, above the national average of 38.8%. When energy is excluded, inflation in Manitoba would be 6.7%.

- Gasoline and natural gas prices, which have increased by 61.1% and 27.8%, respectively, are two factors in Manitoba’s high energy costs. Manitoba’s CPI, excluding gasoline, increased by 7.1%, ranking second among the provinces and surpassing Canada’s 6.5%.

- With 3.7 points (or 39%) of Manitoba’s 9.4% price increase this month coming from the CPI, energy is the major driver of price inflation. Services, which contribute 3.2 points or 34% and have a relative CPI weight of 46.1%, are next in line. Food now has a weight of 16.0%, durable goods have a weight of 15.6%, and other categories now have a weight of 13.2%.

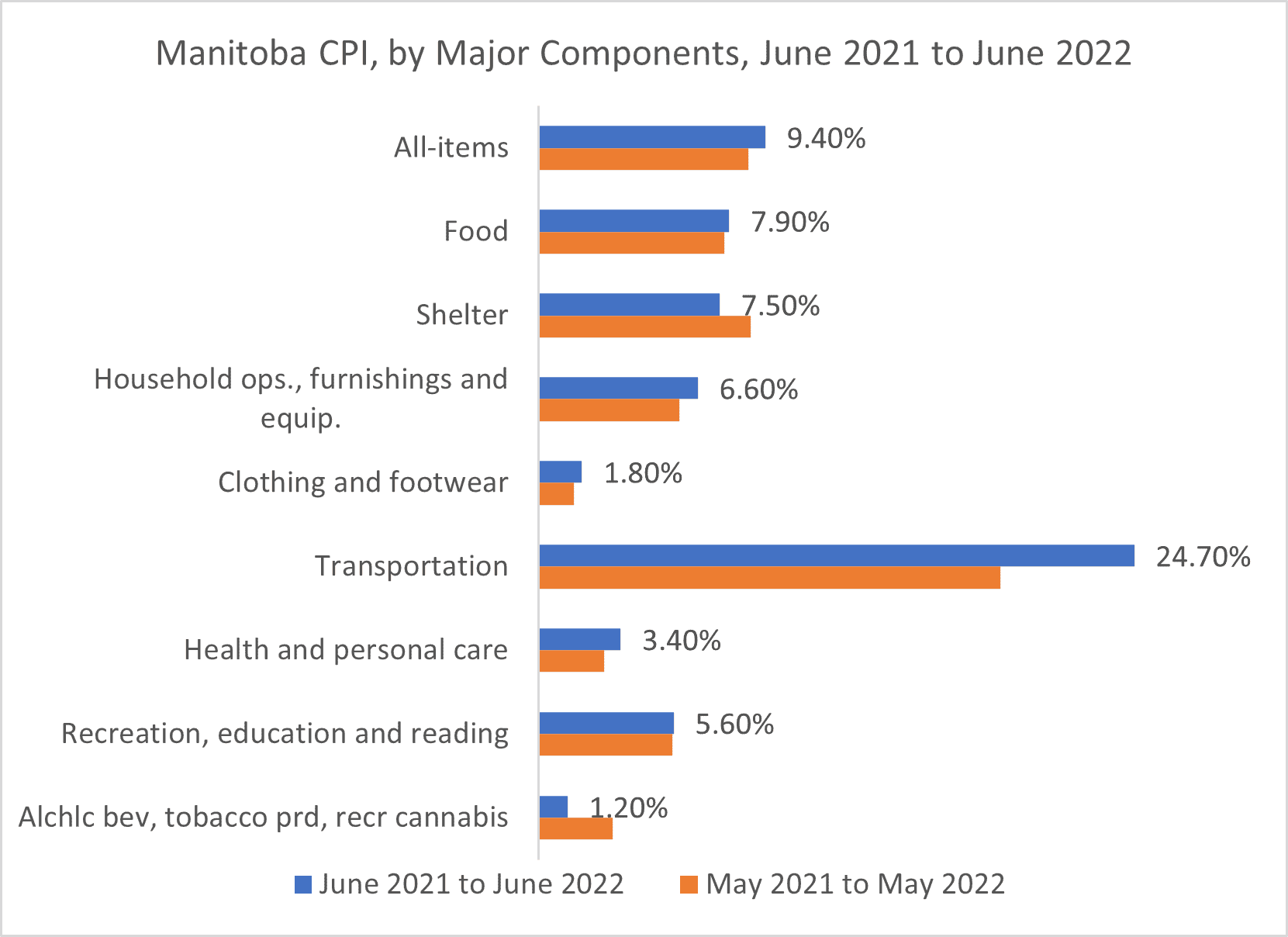

- In June 2022, Manitoba’s consumer prices increased in all eight key components, ranging from 1.2% for clothing and footwear to 24.7% for transportation (Figure 3).

Figure 3 : Source: Statistics Canada, Table 18-10-0004-01

- In June, transportation costs increased in Manitoba by 24.7% compared to a 16.8% increase nationwide. Food prices in Manitoba rose by 7.9% compared to an 8.8% year-over-year increase nationally.

- Among the top 5 factors influencing the 12-month rise in the Manitoba CPI are gasoline, passenger car insurance rates, and the purchase and lease of passenger automobiles. Property taxes and other special charges, recreational equipment and services, mortgage interest costs, prescribed medicines (excluding medical cannabis), and passenger vehicle registration fees are some of the specific categories preventing CPI rise this month.

Interest Rate Hike and Business Impacts

- When a central bank seeks to boost the economy by enticing individuals to borrow and invest, everything else being equal, it lowers the lending rate. When it tries to calm down an overheated economy, it increases rates.

- The key interest rate set by the central bank has significantly increased from the 0.25% rate at the beginning of the year to 2.5%. The bank increased its rate by the full percentage point instead of the three-quarters of a percentage point that economists had predicted it would.

- Even if it was anticipated, the decision to hike the interest rate would cause businesses even more anxiety in the face of a dimmed economic outlook, escalating cost pressures, and a labour scarcity.

- The rise may have an effect on smaller businesses that depend on banking or overdraft services, such as those who purchase items in large quantities to try to make up for shortages of raw materials.

Surviving Increasing Costs

The global recovery from the pandemic triggered supply shortages in industries including energy, electronics, and numerous consumer durables, which are the key causes of the current inflation rate. These problems were made worse by the conflict in Ukraine, which drove up costs even further. In this challenging environment, businesses need to plan to cooperate with suppliers to enhance timeliness, substitute alternative sources, partner with new suppliers, and switch to local providers to address supply chain issues.

Forbes outlined four tips on how to protect the business from increasing costs. They suggested cutting back unnecessary expenses (operating costs, utilities, etc.), getting creative with employee benefits (flexible schedule, enhanced growth opportunities), coming up with new ways to drive sales (tune-up marking strategy, offer new products) and analyzing the business in more detail.