4-5 Minute Read

The Winnipeg Chamber’s Policy & Research Analyst, Jamil Ahmed, highlights current inflation rates.

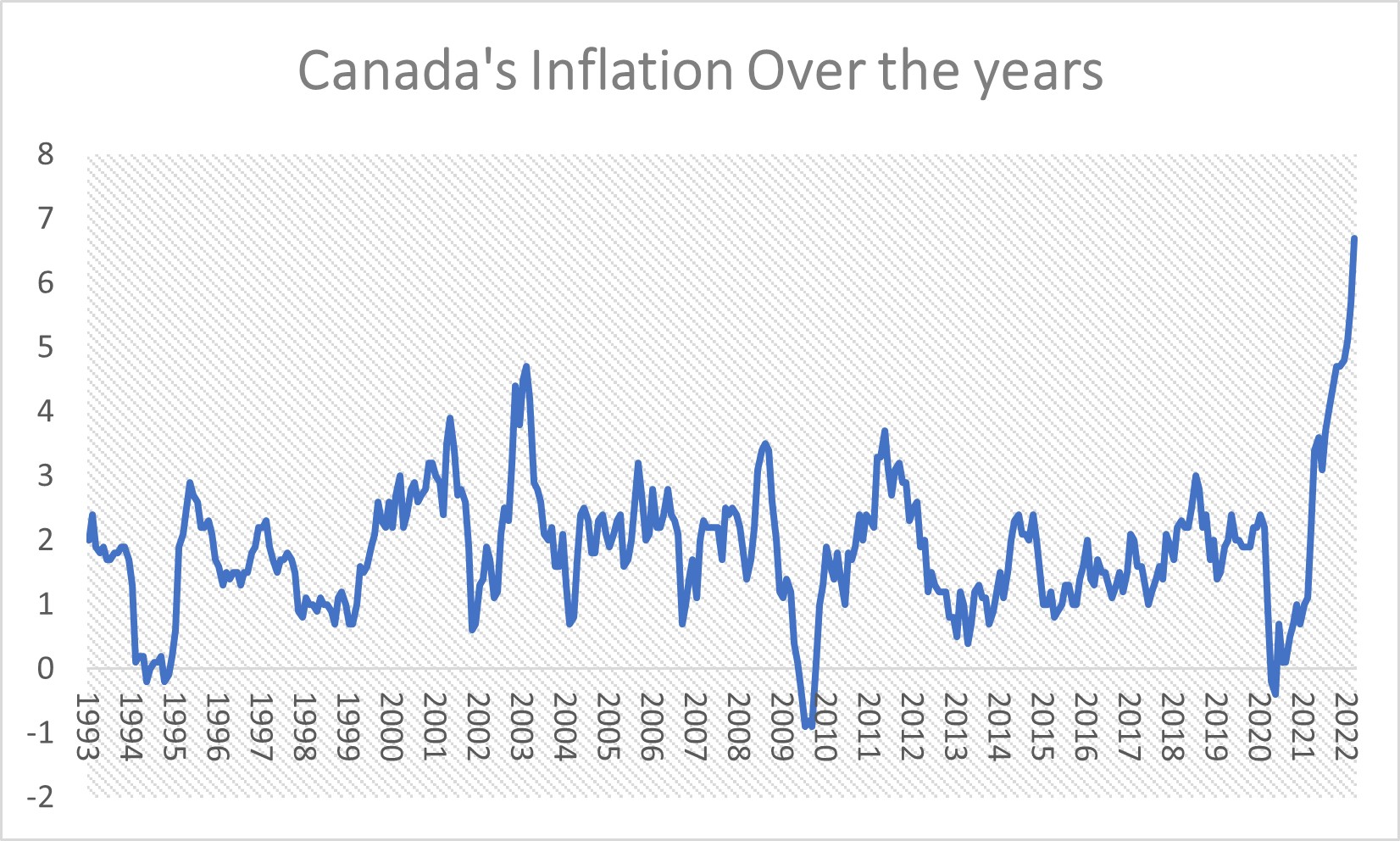

According to Statistics Canada, consumer prices in March 2022 were 6.7% higher than in March 2021, a one percentage point increase over February’s inflation rate (+5.7%). This was the most substantial increase since January 1991 (+6.9%). With the cost of things rising, Canadians are becoming increasingly anxious about their monthly bills rising, and businesses anticipate their expenditures going up for the months ahead.

What is Inflation?

When the price of products and services rises, the average person’s purchasing power reduces. People and companies must spend more money to purchase the same quantity of products and services as inflation rises. To put it another way, everything costs more. In economics, “inflation” is only used when a price increase is a long-term trend rather than a one-time occurrence.

Key Takeaways:

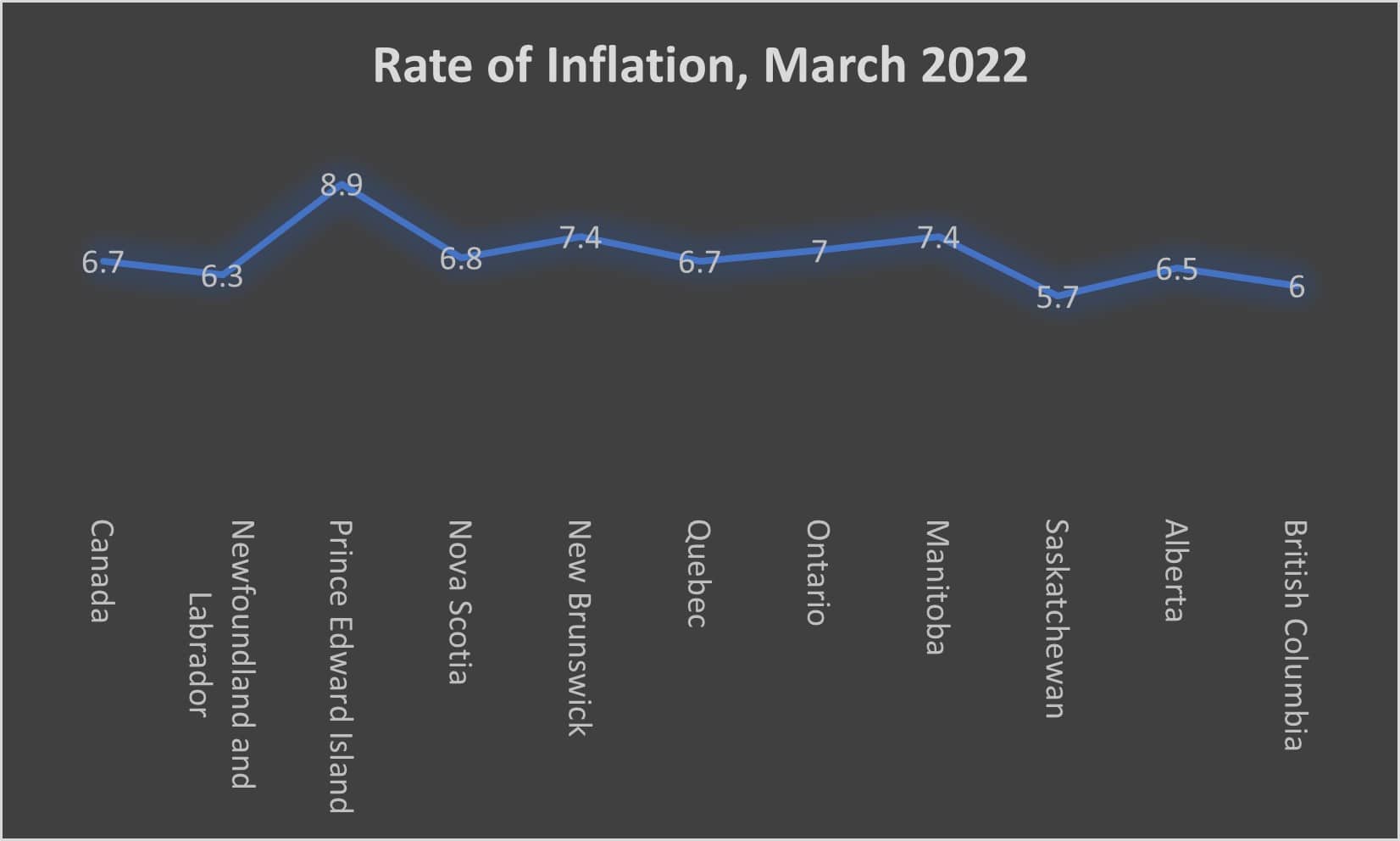

- In March 2022, the Manitoba All-items Consumer Price Index (CPI) increased by 7.4%, the greatest year-over-year increase since May 1983 (+7.6%). In March, Canada’s annual price growth rate was 6.7%, up 1.0 percentage points from February, the largest since January 1991 (6.9%).

- Manitoba was tied with New Brunswick for the second-largest all-items price rise among Canada’s ten provinces in March, at 7.4%. Saskatchewan had the smallest price increases, at 5.7%, while Prince Edward Island had the highest year-over-year price growth, at 8.9%.

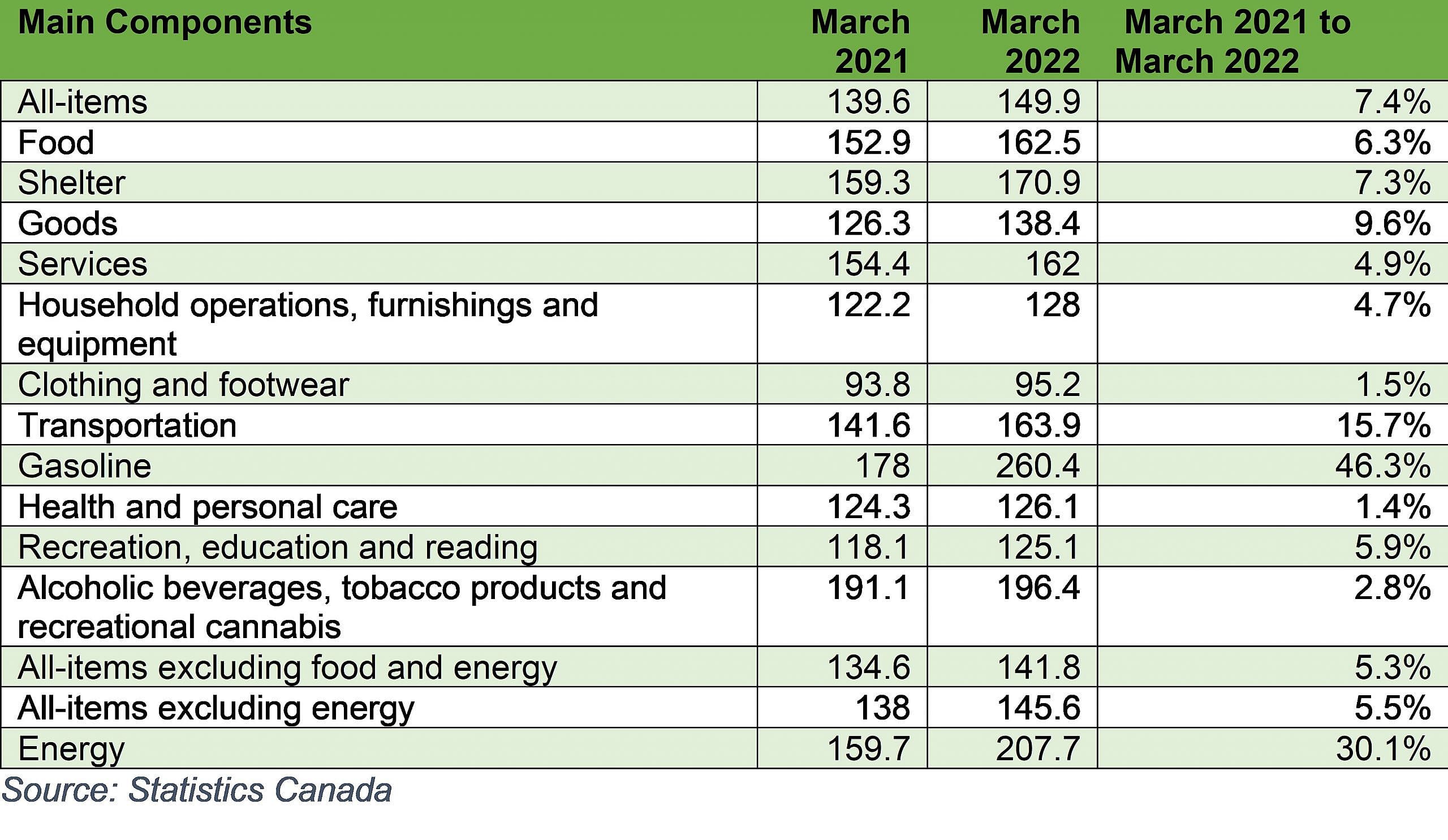

- While Canadian energy costs increased by 27.8% year over year, Manitoba’s energy prices increased by 30.1% (the fourth greatest rise among provinces). Gasoline and natural gas, which are up 46.3% and 14.9%, respectively, contribute to Manitoba’s high energy price index. Manitoba’s CPI, Excluding Gasoline, increased at the fourth-fastest rate in the country, at 5.6%, surpassing Canada’s 5.5%.

- In Manitoba, Seven categories saw greater year-over-year price changes in March than in last years estimate. Transportation (up to 15.7%), Household operations (up to 4.7%), Recreation (up to 5.9%), and Food (up to 6.3%) have seen the most change. Only health and personal care (down to 1.4%) and alcohol and cigarettes saw a lower price increase in March (down to 2.8%).

- The average of the three Bank of Canada “core inflation” indicators has risen to 3.8%. The Bank of Canada increased the policy interest rate to 1%, to control inflation. More interest rate rises are underway, with the Bank of Canada officially “locked-in” for another 50 basis point boost in June.

Source: Statistics Canada

Source: Statistics Canada

Source: Statistics Canada

Source: Statistics Canada

Table 1: Consumer Price Indices for March 2022 By Component: Manitoba (2002 = 100)