5-minute read

Written by Jamil Ahmed, Policy and Research Analyst

For the second consecutive time, the Bank of Canada (BoC) has kept its benchmark interest rate unchanged at 5%. It is becoming evident that the central bank may be stepping to the sidelines after a series of rate hikes over the past year. The decision not to raise rates further reflects a cautious approach in the face of an evolving economic landscape.

Here are the key highlights from the BoC’s Monetary Policy Report:

- The BoC has signaled its intention to continue its quantitative tightening efforts.

- Inflation has come down from its peak, but it remains at high levels due to supply chain disruptions and increased energy prices, among other factors.

- The economy is showing signs of cooling down as a result of previous rate hikes. However, the BoC emphasizes the need for more time to see the full effects of its monetary policy.

- The BoC recognizes that inflation easing would be a gradual process, given the persistent factors driving up prices, such as higher energy costs, housing expenses, and wage growth.

- Inflationary risks have increased due to rising oil prices, escalating shelter costs, and persistent wage inflation.

- Wage inflation remains elevated, which can contribute to overall inflationary pressures. This factor is closely monitored as it reflects the health of the labour market.

- The report also mentions rising global tensions, which can have ripple effects on the Canadian economy, including potential impacts on trade, investment, and financial markets.

Expectations and Outlook

- The BoC anticipates that inflation will hover around 3.5% through the middle of 2024. However, they expect a gradual easing of inflation in 2024, eventually reaching the 2% target in 2025.

- The BoC expects GDP growth to remain below 1% for the next quarter, reflecting the recent economic slowdown. They predict a pickup in growth in late 2024 and a rise to 2.5% in 2025, suggesting a gradual recovery in economic activity.

Inflation Dynamics

The softening of the economy and slower inflation encouraged the BoC to keep interest rates unchanged for a second consecutive period. Moderate price pressure has been observed, but businesses have not returned to their regular price-setting behaviour. This further illustrates that interest rates might remain higher for longer than expected to bring back price stability. Both consumers and businesses think of the constraints of higher interest rates as we observe a reduction in local spending.

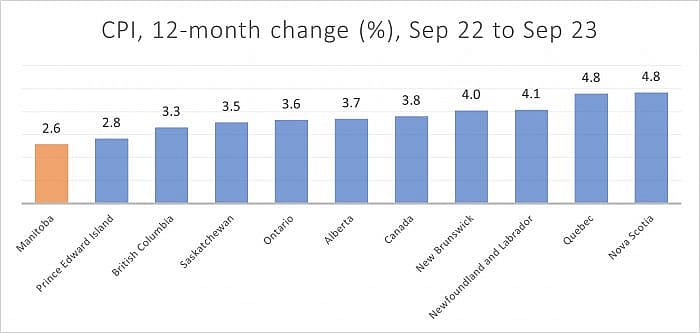

In the context of the BoC’s recent policy decisions, Canada’s annual inflation rate slowed to 3.8% in September, signifying a deceleration in prices for various goods and services. Notably, Manitoba stands out with the lowest year-over-year price increase among Canadian provinces in September, with a 2.6% rise compared to September 2022.

Source: Statistics Canada

Manitoba’s 2.6% price growth is multifaceted. Service and food were significant contributors, while energy had little impact. The top contributors to the 12-month change in CPI include mortgage interest costs and food purchased from restaurants, along with rent, homeowners’ home and mortgage insurance, and passenger vehicle parts, maintenance, and repairs. Conversely, individual items limiting CPI growth this month include telephone services, travel tours, gasoline, internet access services, and homeowners’ replacement costs.

The average hourly wage for Manitoba employees rose by 3.9% year-over-year in September 2023, reaching $29.93. In contrast, Canada’s hourly rate increased by 5.0%, reaching $34.01 over the same period.

Manitoba Labour Market Overview

Manitoba’s labour market showed resilience, with the unemployment rate at 5.0% in September 2023, down 0.7 percentage points from the previous month and below the national rate of 5.5%. Job growth, particularly in the private sector, and a rise in full-time employment, coupled with an increase in average hourly wages, paint a positive picture of Manitoba’s economic performance.

In conclusion, the Bank of Canada’s decision to maintain its interest rate amidst economic uncertainty and evolving conditions reflects a cautious approach to managing inflation while allowing the economy to stabilize. The careful stance is justified, particularly at a time when businesses are facing soaring inflation, rising input costs, and the pressure of rising interest rates.