4 minute read

Written by Jamil Ahmed, Economic Analyst

Businesses have until Thursday, January 18, to repay their CEBA loans to have them partially forgiven: $10,000 forgiven for loans of $40,000, or $20,000 for loans of $60,000.

Businesses that are currently negotiating refinancing with their banks can take a little longer, up to March 28. After those dates, the loans are due in full and will begin accruing interest at a 5 % annual rate. Everything must be repaid by December 31, 2026.

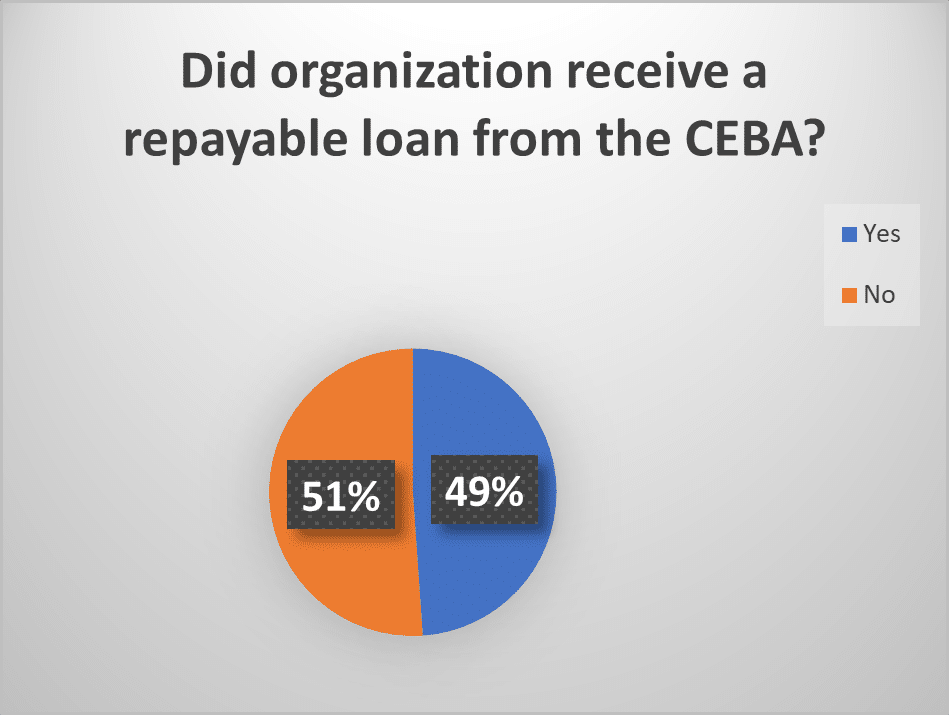

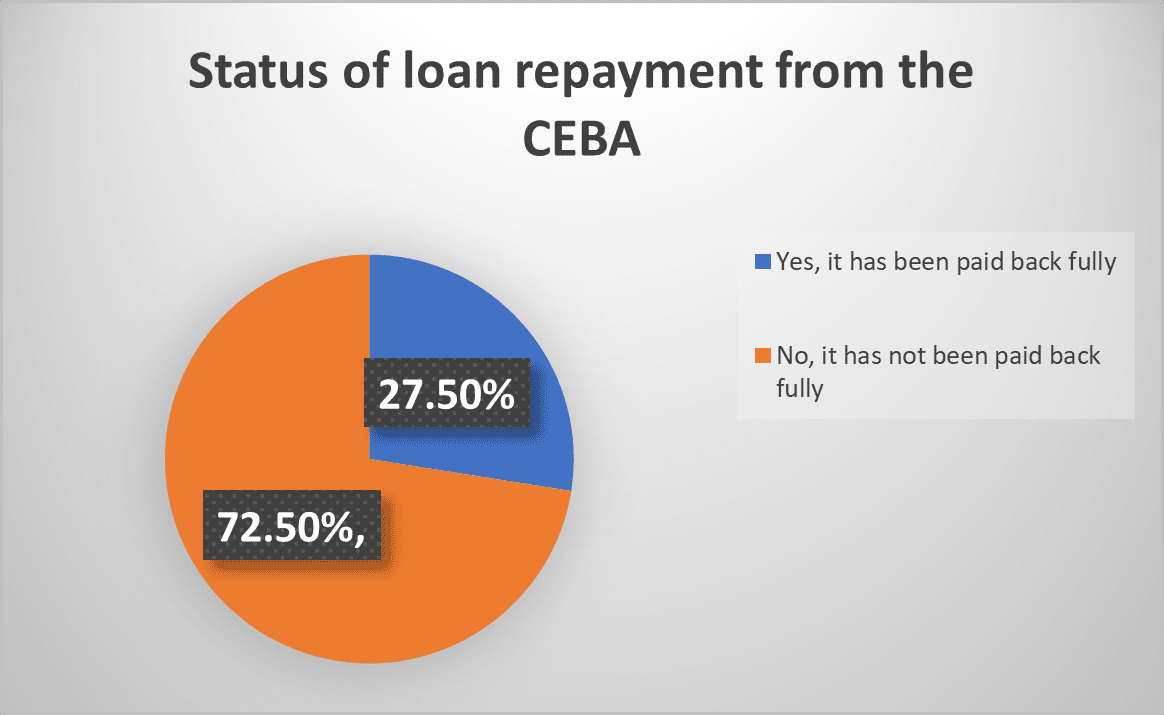

In Manitoba, 23,424 Manitoba businesses received a collective $1.27 billion in CEBA loans – these businesses are across various industries, however, sectors including arts, entertainment and recreation and accommodation and food services make up nearly half of these loans. About a quarter of these loans had been paid back by the end of 2023, according to the Q4 2023 data from The Canadian Chamber’s Business Data Lab (BDL). This represents $ 952.5 million of credit still outstanding as of Dec. 31. The BDL also projected that 76 percent of CEBA loans would be paid back in full by the end of 2026.

If that number holds true, it will mean millions of dollars of debt for those small businesses and lost revenue for the federal government, which is underwriting the CEBA program.

The Winnipeg Chamber of Commerce, in addition to many other organizations, actively advocated for the extension of the CEBA loan repayment deadline, underscoring the critical role of policy in supporting the recovery of small and medium-sized businesses. These businesses, which form the backbone of our economy, are grappling with unprecedented challenges such as high interest rates, inflation, and increased labour costs. An extension would have not only provided immediate relief but also contributed to the long-term resilience and growth of our economy.

All of these pressures, accompanied with the increase in payroll taxes (EI and CPP) on January 1, is not a good start to 2024 for small businesses. We will be watching closely the CEBA repayment as a key economic indicator over the next year and its impact on the economy.

Sources: Business Data Lab Analysis on Statistics Canada, Canadian Survey on Business Conditions, Global and Mail