4-minute read

Written by Jamil Ahmed, Policy & Research Analyst

Our Policy & Research Analyst has put together a closer look at the factors influencing inflation in Canada and Manitoba as well as information about the labour skills gap problem in Canada and our role in the future.

- In September 2022, Manitoba’s unemployment rate was 4.5%, 0.8 percentage points lower than the previous month and less than Canada’s rate of 5.2%. With a 4.1% unemployment rate, Saskatchewan has the lowest rate among the provinces. The province with the highest unemployment rate was Newfoundland & Labrador (9.5%). The unemployment rate in Manitoba is down 1.2 percentage points from September 2021.

- Given the low unemployment rate, employers will continue to face significant competition for workers, especially in the accommodation / hospitality sector.

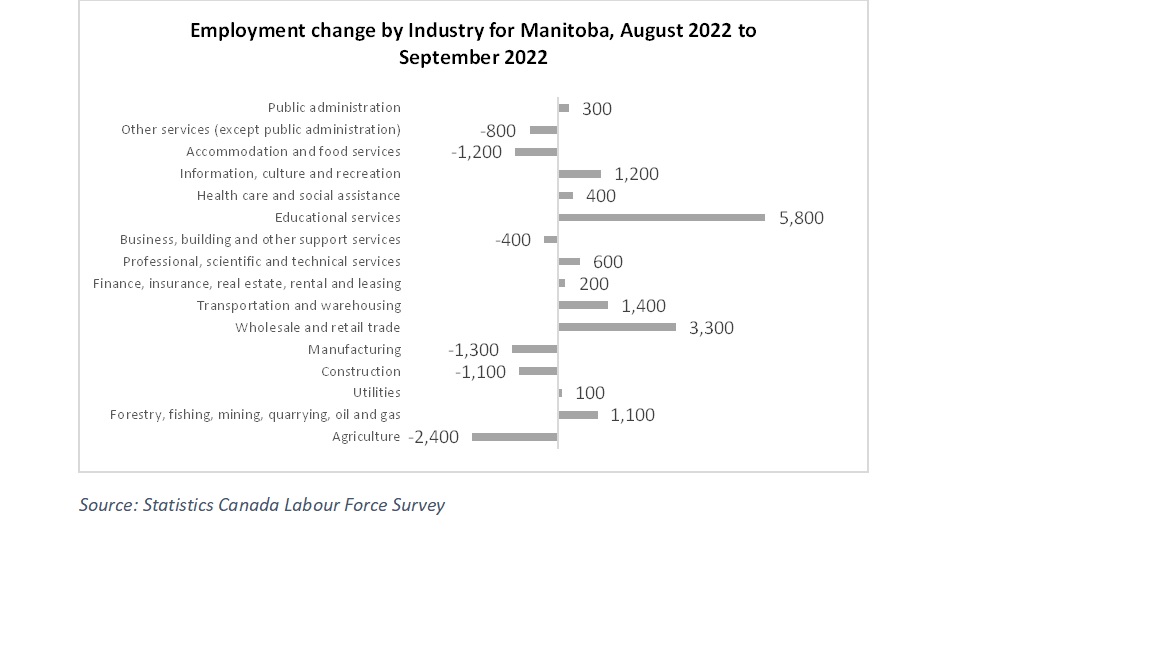

- Since August 2022, education services in Manitoba has the most monthly job increase of all the industries adding 5,800 (+9.7%) jobs in September 2022– likely as a result of schools ramping up staffing levels to coincide with the start of the school year. Employment in Manitoba’s service-producing sectors has expanded by 10,500 positions (+2.0%). 3,600 fewer jobs (-2.5%) were lost in the industries that produce products. Agriculture saw the most employment loss (-2,400; -14.0%).

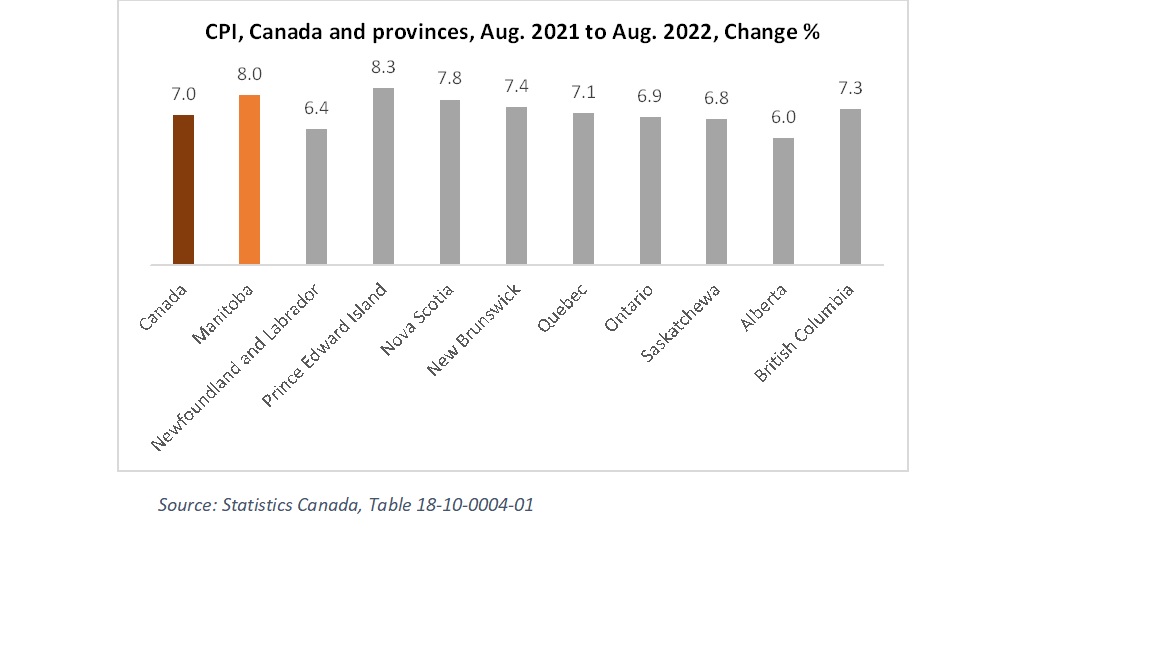

- According to Statistics Canada, the pace of inflation slowed somewhat in Canada as the Consumer Price Index (CPI) increased by 7% in August compared to the same month last year, down from a percentage increase of 7.6% in July. Inflation has dropped from the nearly four-decade peak of 8.1% in June.

- Consumers are likely seeing the impact of inflation on their purchasing power and some may feel they will have to make tough choices about what they can buy. As the pace of inflationary increase is still high by recent standards, businesses will also feel the rising price of input costs.

- Maniotba’s inflationary increase is higher than the national average. At 8% in August 2022, the All-Items CPI was a bit lower than it was in June and July when it rose by 9.4% and 8.8%, respectively, year over year. Manitoba is ranked second among provinces, while Prince Edward Island had the greatest inflation (+8.3%). Alberta had the lowest (+6.0%) (Figure 1).

- The rising cost of services are contributing to Manitoba’s inflation, which generated 3.3 points or 41% of Manitoba’s 8.0% price rise this month, with a relative CPI basket weight of 46.1%. Following that is the rising cost of energy, which contributed 1.9 points (24%), while making up only 9.1% of the CPI basket weight. CPIfor energy in Manitoba was higher than the national average of 19.0%.

- In August 2022, Manitoba’s CPI (year over year) climbed 6.0%, excluding food and energy. All provinces saw increased consumer prices in food and energy, topped by British Columbia (+6.3%). With a 3.5% rise, Newfoundland and Labrador saw the least increase.

- In August, Manitoba’s CPI rise over the prior year (excluding energy) was 6.8% compared to the national average of 6.1%. British Columbia and Manitoba had the highest CPI (excluding energy) year-over-year gains, while Newfoundland and Labrador (+4.7%) saw the slightest change.

- In August 2022, Manitoba’s CPI for food jumped 10.8% from the previous year, the largest rise among the provinces. Food costs nationwide increased by 9.8% over the previous year. Food inflation rates were lowest in Nova Scotia Alberta and British Columbia (all +9.4%), which is the highest growth rate since 1981.

- As an essential cost for families, rising food costs may affect discretionary spending.

- The countrywide rise in food prices is 6.5% for meat, 7.0% for dairy goods, 15.4% for bread products, 13.2% for fresh fruit, 14.1% for non-alcoholic drinks, 17.2% for sauces, spices, and vinegar, 11.3% for sugar and confectionary, and 8.7% for fish, shellfish, and other marine products.

- Prices for some CPI constituents can fluctuate a much. These factors can significantly affect the overall CPI, as well as changes in indirect taxes like GST. When determining monetary policy, the Bank aims to ignore such cyclical fluctuations in total CPI inflation and instead focuses on “core” inflation measures that more accurately capture the overall trend in inflation.

- The CPI-Common climbed 5.7%, the CPI-Median increased 4.8%, and the CPI-Trim increased 5.2% in Canada as compared to August 2021. The all-items CPI, formerly known as CPIX, increased 5.8% year over year after the Bank of Canada excluded eight of its most volatile components and took indirect tax adjustments out of the equation. We might see further interest rate hikes from the Bank of Canada at the end of month October to tame inflation.

Survey of Employers on Workers’ Skills

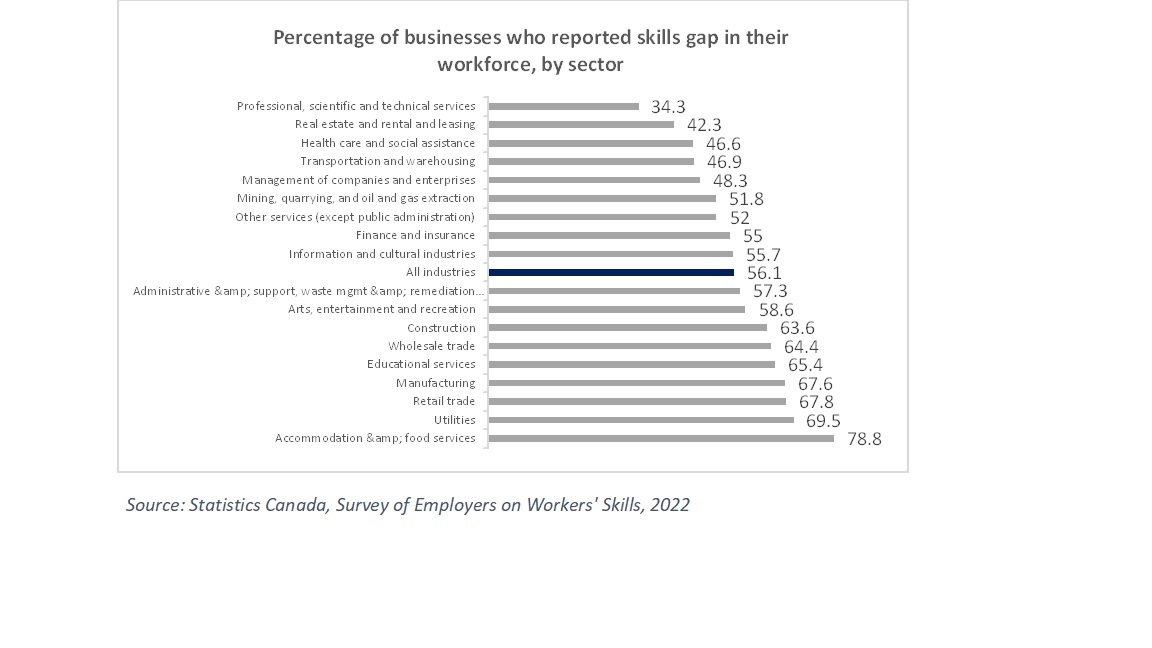

According to the Statistics Canada survey, In 2021, more than half (56.1%) of Canadian businesses indicated that their overall employees lacked the necessary skills to carry out their jobs to the appropriate level. 60.3% of organizations said they have experienced at least one adverse effect as a result of their workforce’s skills gap. In almost three-quarters (73.9%) of these organizations, additional staff members’ workloads rose.

The majority of industries—78.8% of businesses—in the accommodation and food services sector—reported having a skills gap in their workforce. Businesses in the utility sector had the second-highest rate (69.0%), followed closely by those in the retail trade (67.8%), manufacturing (67.3%), educational services (64.8%), wholesale trade (64.4%), and construction (63.6%). In contrast, businesses in the professional, scientific, and technical services sectors reported the lowest rate (34.3%), followed by the real estate, rental, and leasing sectors (42.3%).

To compete in the 21st century, more than half of the firms interviewed (57.5%) stated their workforce has to develop. Technical, practical, or job-specific abilities, followed by problem-solving skills, are the talents that need the most improvement. Less than 1 in 10 companies, on the other hand, stated that their workforce’s reading comprehension and foundational math and calculation abilities needed to be improved.

44.5% of organizations reported having trouble finding applicants with the necessary abilities to do the job at the required level. Construction (54.8%), manufacturing (57.0%), and lodging and food services (63.2%) also reported somewhat high rates of hiring challenges. More than 7 in 10 businesses will provide training to their employees in 2021.

For little under one million (964,000) open vacancies, businesses were actively seeking candidates. The job vacancy rate, which measures the number of open positions as a percentage of total labour demand (the sum of open and filled positions), was 5.4% in July, down from 6.0% in April 2022 and from June’s peak of 0.4 percentage points. Undoubtedly, there is a labour scarcity, but there is also a skill shortages too. Moving forward, we need an economic strategy that includes a plan to develop and expand Manitoba’s workforce. We need to Develop a workforce strategy matching skills to the job by providing funding and training to bridge the skills gap and encompassing post-secondary and new Canadians (credential recognition).