5-minute read

Written by Jamil Ahmed, Policy and Research Analyst

The recent interest rate announcement by the Bank of Canada to maintain the policy interest rate at 5% has stirred national discussions. The decision made by the Bank of Canada carries profound implications for the province of Manitoba, influencing the broader economic health of the region.

Understanding the Interest Rates Hike Pause

The Bank of Canada’s decision to hit pause on interest rate-hike campaign at 5% amid signs the Canadian economy has begun to stall. It reflects the recognition that consumer spending has moderated, and the pressure from excessive demand has alleviated. This pause also implies that borrowers with floating-rate debt, including variable-rate mortgages and lines of credit, will experience some relief as the Bank of Canada begins the process of unwinding the rate increases implemented since March 2022.

Domestic Economic Challenges

The announcement also highlights domestic economic challenges, including a recent slowdown in Canadian economic growth driven by factors such as reduced consumption and housing activity. Canadian local spending tracker shows that consumer spending is slowing down. Local businesses should remain prepared to adapt to these changing conditions and consider diversifying their customer base if they heavily rely on domestic demand.

Inflation and Wage Pressures

The Bank of Canada’s expressed concerns about persistent inflationary pressures are noteworthy. The annual Consumer Price Index (CPI) inflation continues to surpass the central bank’s 2% target, registering at 3.3% in July. The Manitoba All-items Consumer Price Index (CPI) rose 2.6% in July 2023 compared with July 2022. Besides, average hourly wages for Manitoba employees rose 5.8% ($29.59) year-over-year in August 2023. Local businesses must closely monitor their input costs and pricing strategies to mitigate the impact of inflation on their bottom line.

Manitoba’s Labor Market Resilience

As we delve into the economic landscape of Manitoba, it’s evident that the province has been navigating a dynamic labour market in recent years. In this article, we take a closer look at the unemployment trends that characterize Manitoba’s labour market.

Overall Unemployment Trends

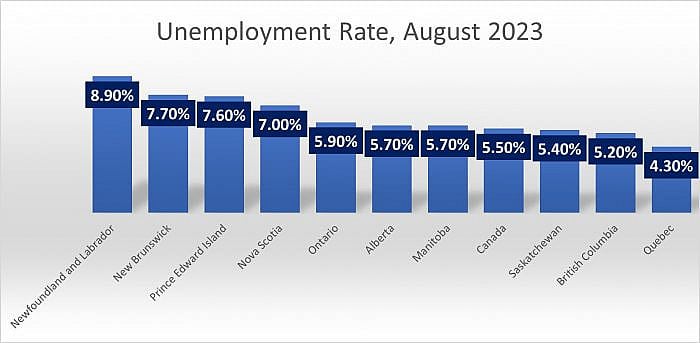

In July, Manitoba’s unemployment rate was 4.90%, lower than the national average of 5.50%, which aligns with its historical trend of having a slightly lower rate. However, in August, Manitoba’s unemployment rate increased slightly to 5.70%, placing it on par with Alberta. While this uptick may seem concerning, it’s important to note that it remains within the range of the national average, and Manitoba still fares better than several other provinces, including those in Eastern Canada, such as Newfoundland and Labrador, New Brunswick, and Prince Edward Island, which consistently report higher unemployment rates.

Source: Statistics Canada

Industry-Specific Challenges

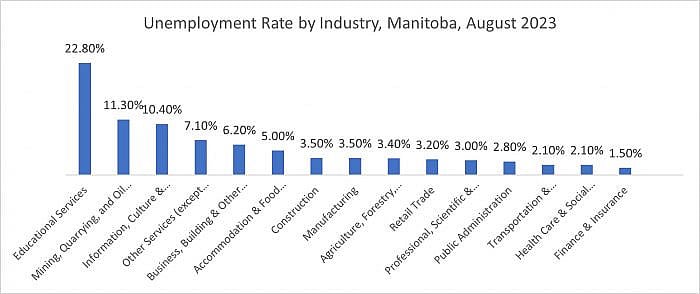

Examining Manitoba’s labour market by industry reveals disparities. “Educational services” and “Mining, quarrying, and oil and gas extraction” face significant challenges, with 22.80% and 11.30% unemployment rates, respectively. In contrast, “Retail trade,” “Manufacturing,” and “Wholesale trade” maintain lower rates at 3.50% and 3.2%, highlighting the importance of sector diversification and support.

Source: Statistics Canada

Demographic Challenges and Job Vacancies

Examining age-related unemployment, August 2023 data shows a 9.40% rate for those aged 15 to 24, highlighting challenges for young job seekers. In the first quarter of 2023, job vacancies reached 28,140, offering opportunities for both job seekers and businesses. Addressing the skills gap through focused workforce training is essential to connect job seekers with these openings.

Source: Statistics Canada

Conclusion

The Bank of Canada’s decision to halt its 18-month-long rate-hike campaign at 5% reflects a response to a mixed economic landscape. While inflation remains above the 2% target, recent data, including the surprising second-quarter GDP contraction of 0.2% against expectations of 1.5% growth, suggests economic challenges. This pause in rate hikes may signal the Bank of Canada’s recognition of the need to balance inflation control with supporting economic growth, and their further actions will be centred on monitoring key economic indicators closely.