The Winnipeg Chamber of Commerce welcomes Manitoba Budget 2025’s focus tariff response measures, infrastructure investments, and Payroll Tax relief. However, we urge the province to take bolder, more decisive action on innovation, workforce development, and productivity to drive sustained, long-term growth.

Regarding U.S. tariffs, should they prolong and expand in scope, Budget 2025 calls for:

- Tax deferrals for Manitoba businesses (announced March 4).

- $100 million in targeted supports to help businesses pivot to new markets.

- $100 million in loans for Manitoba businesses.

- $100 million in support for farmers and producers.

- $100 million for program and services to support families.

- $50 million in new funding to post-secondary institutions to support retraining for Manitoba workers.

- $10 million more in student aid grants and $25 million more in student loans to help workers train for new jobs.

- A revenue contingency of $600 million.

The Chamber is pleased to see funding allocated to help offset the impacts from U.S. tariffs. However, the specifics of these programs are crucial for businesses to plan effectively.

“Quebec, New Brunswick and Prince Edward Island have detailed business support programs that include loans and direct grants. While a broad commitment and funds set aside are welcomed, we need more specifics from Manitoba as to who may be eligible, what support levels look like, repayment or forgiveness parameters, and so forth. We will collaborate with the government to ensure these programs meet the needs of businesses and provide the right solutions.” Loren Remillard, President and CEO, The Winnipeg Chamber of Commerce

The Chamber appreciates the measures outlined in Manitoba Budget 2025, in particular those that aligned and responded to our 2025 prebudget submission.

Tax Measures

Effective January 1, 2026, the payroll exemption will increase from $2.25 million to $2.5 million, and the reduced effective rate threshold will rise from $4.5 million to $5 million.

Investments

Substantial infrastructure investments are a pivotal move towards enhancing Manitoba’s logistical efficiency and fostering long-term economic prosperity.

- $36.4 million over two years in a provincial investment to develop the Port of Churchill and Hudson Bay Rail Line.

- $500,000 to the Export Support Program to help businesses expand their trading markets beyond U.S.

- $450,000 in operating funds to CentrePort Inc.

- $30 million a year for the next four years for Phase 2 of the North End Water Pollution Control Centre, as part of a total commitment of $414 million.

Responsible Fiscal Management

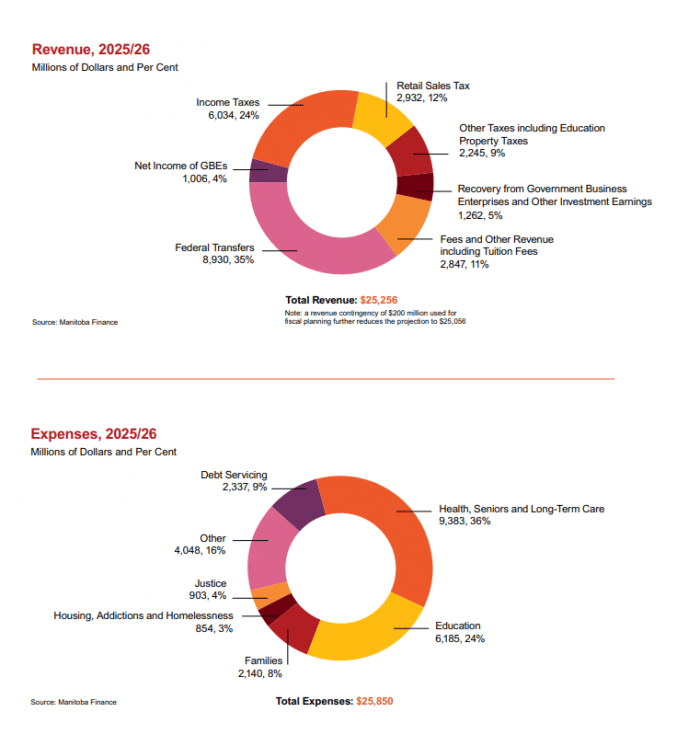

Budget 2025 projects $25.2 billion in revenue, an increase of $1.719 billion from Budget 2024. Overall spending is expected to rise to $25.8 billion, up $1.717 billion from the previous year. The government is budgeting for a $794 million deficit, which could increase to $1.89 billion due to tariff response measures.

In 2025, the province’s real gross domestic product (GDP) is expected to rise to 1.7%. The net debt-to-GDP ratio for the fiscal year ending March 31 is forecasted to be 36.1% for 2024/25, down from the 38.5% projected in Budget 2024. For 2025/26, the ratio is expected to rise to 36.9%.

Other investments of note included:

- $10 million for a new business security rebate.

- 2% increase to municipal base operating grants plus a dedicated 4% of the gas tax through the new One Manitoba Growth Revenue Fund.

- $750,000 to eliminate Provincial Nominee software application limitations